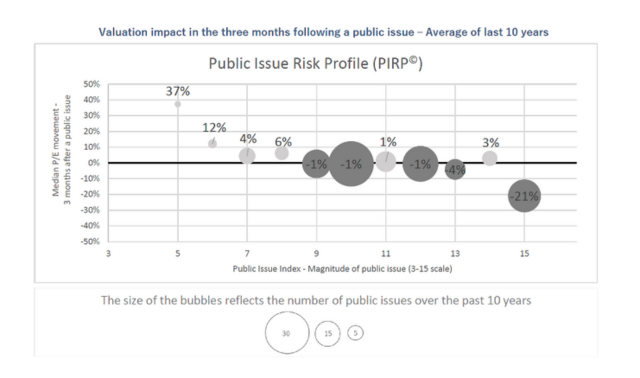

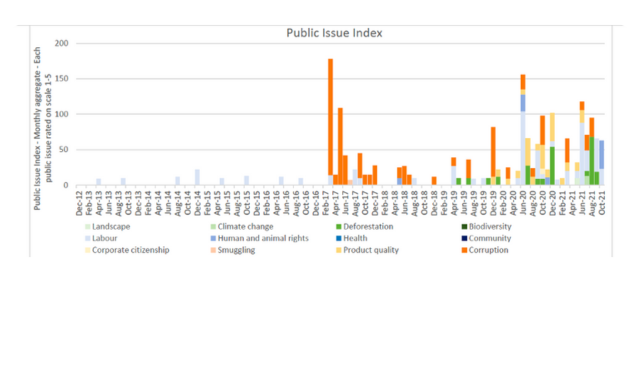

TDi Sustainability partnered with Denny Ellison, a London-based equity research and training organisation, to develop a unique ESG valuation methodology to quantify the valuation impact of ESG-related public allegations on companies that operate in sectors with significant ESG contention, or ‘sin stocks’.

This is summarised in the report produced by TDi and Denny Ellison, ‘The Real Value of Sin Stocks’ which applies the methodology to a Brazilian beef producer. The report provides an evidence-based valuation of the underperformance of sin stocks, but also assesses the potential valuation upside from company-specific ESG initiatives, revealing their real value to investors.

The term ‘sin stocks’ refers to companies operating in the tobacco, gambling and firearms sectors, as well as the so called ‘brown’ companies, i.e. those operating in carbon intensive industries, such as commodity producers like gold miners, oil & gas producers and agriculture and farming companies.

The methodology offers an evidence-based valuation tool to quantify the underperformance of sin stocks but also assesses the potential valuation upside from company-specific ESG initiatives, i.e. increased disclosure, commitments, and implementation on specific ESG matters, hence revealing their real value to investors.

The methodology is summarised in the report produced by TDi and Denny Ellison, ‘The Real Value of Sin Stocks’ which applies the methodology to a Brazilian beef producer. The report provides an evidence-based valuation of the underperformance of sin stocks, but also assesses the potential valuation upside from company-specific ESG initiatives, revealing their real value to investors.

Download the Report for free

We are interested to know who is reading and benefiting from this report. Please supply your details below to receive a link to download the report for free. Note that this information is for internal reference only.