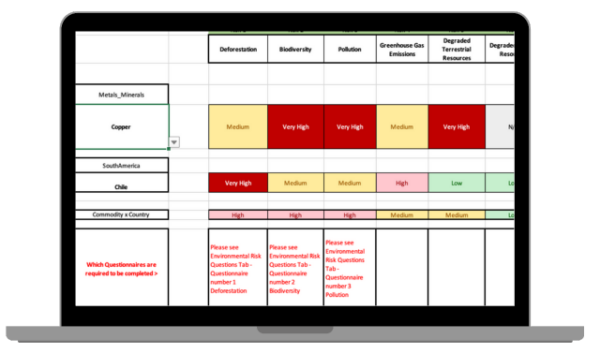

A UK-based financial institution asked TDi to put together a toolkit for investors to use to effectively manage risk, unlocking sustainable trade and supply chain finance opportunities that could deliver positive environmental and social impacts. The client wanted a toolkit that would evaluate the risk exposure of more than 200 commodities across high risk level categories including agriculture, energy, precious metals and gemstones, metals and minerals, and food and beverages. The brief was for the toolkit to be easy for its team to use at different stages of the investment process and lifecycle, including due diligence, monitoring and benchmarking.

TDi took a two step process to identify the inherent risk exposure for each commodity:

- SALIENCE ANALYSIS: Using TDi Digital’s Search 360 tool, we identified the prevalence and gravity of environmental and social risks including biodiversity loss, child labour, community rights and modern slavery.

- COUNTRY LIKELIHOOD RISK: the ESG risk level inherent in each country was then used to identify a country risk score.

Country and commodity risk scores were combined to develop an overall risk score. This approach provided a data-driven comparative analysis of E&S risk that could be used to form the starting point for identification and segmentation of suppliers for further E&S assessment activities using a risk-based approach.

TDi then developed a questionnaire containing specific risk questions to be completed as a second phase of risk mitigation to help investors ensure suppliers have appropriate risk mitigation actions in place for the risks identified through the toolkit.